GST Registration Online - Process, Documents Required, Fees & Limit

For specific businesses, GST registration is obligatory. Per GST rules, entities with turnover exceeding ₹40 lakhs must register as a normal taxable unit. This entails the process of Goods & Services Tax (GST) registration for businesses.

Engaging in business without GST registration is a GST offense, attracting substantial penalties. Explore details on GST threshold, registration process, required documents, and associated fees to ensure compliance.

What is GST registration?

Businesses exceeding the threshold of 40 Lakhs must register under GST. The turnover limit is 10 Lakhs for entities in hill states and North-Eastern states. The GST registration process is typically completed within 6 working days, ensuring a smooth transition into the Goods and Services Tax system for eligible businesses.

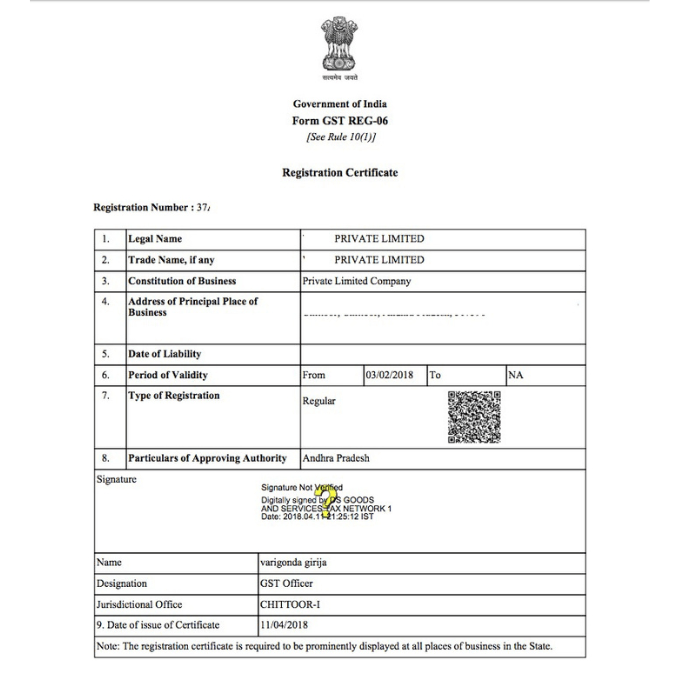

After GST registration, the government issues a unique 15-digit GSTIN, crucial for assessing a business’s tax liability, ensuring compliance, and facilitating seamless transactions in the GST framework. It acts as a distinctive marker, streamlining interaction with the taxation system, promoting transparency. The GSTIN is a valuable tool for authorities to monitor and manage tax compliance, fostering an efficient and accountable tax ecosystem.

Eligibility for GST Registration / GST Threshold Limit

- 1. Entities registered under the previous tax laws such as Excise, VAT, and Service Tax, transitioning to GST.

- 2. Firms surpassing the turnover limit of $40 Lakhs (or $10 Lakhs for select states: North-East, J&K, Himachal Pradesh, and Uttarakhand).

- 3. Entities with temporary or foreign tax liabilities fall under the category of temporary taxable or foreign taxable entities, respectively.

- 4. Supplier representatives and Input Service Distribution unit.

- 5. Taxpayers under the reverse charge mechanism.

- 6. Supplier through an e-commerce aggregator.

- 7. Every e-commerce platform operator.

- 8. Provider of online information and database access services from outside India to an unregistered individual in India.

GST Registration Process

The procedure of GST registration is as follows:

- 1. TRN Generation

- 2. Documents Uploading

- 3. Show Cause Notice (if deficiency)

- 4. Reply to Notice (if deficiency)

- 5. Issuance of GST certificate (GSTIN)

GST Registration Fees

The total cost of registering a business under GST with Professional Utilities is $999 Only!

Documents Required for GST Registration

- 1. Copy of PAN Card of the Applicant.

- 2. Copy of Aadhaar Card.

- 3. Incorporation Certificate or Business Registration Proof.

- 4. Address Proof (Rent Agreement / Electricity Bill).

- 5. Canceled Cheque / Bank Statement.

- 6. Digital Signature.

- 7. Passport size photograph.

- 8. Letter of Authorization / Board Resolution for Authorized Signatory.

Penalty for not registering under GST

In case of non-payment or underpayment of tax, a penalty of 10% of the due amount is imposed for genuine errors, with a minimum penalty of 10,000.

Deliberate non-registration for GST with an intent to evade tax incurs a penalty of 100% of the due tax amount.