FSSAI Registration Online in Delhi: Process, Documents, Fees

As the capital and a metropolitan hub, Delhi’s food industry, with its unique blend and street food culture, requires thorough regulation by authorities to ensure consumer safety.

Mandatory FSSAI registration ensures food safety, helping authorities verify compliance with standards, preventing adulteration in food products sold by businesses.

Thus, the Food Safety and Standards Authority of India (FSSAI) has implemented FSSAI registration for food businesses in Delhi, ensuring compliance with safety standards.

FSSAI registration in Delhi for food businesses, whether small or large-scale, can be conveniently completed via the FSSAI-FosCos online portal, following a similar process.

What is FSSAI?

The Food Safety and Standards Authority of India (FSSAI) serves as the regulatory body for ensuring food safety and standards. Operating under the Ministry of Health & Family Welfare, it enforces the Food Safety and Standards Act, 2006, along with the Food Safety and Standards regulation, 2011. The FSSAI plays a pivotal role in establishing and upholding the regulatory framework for food safety, standards, and regulations in India.

What is FSSAI registration?

The 14-digit FSSAI registration number is universally assigned to food business operators after registration. It serves various promotional purposes, ensuring adherence to food safety standards and building consumer trust in the market.

Benefits of FSSAI registration in Delhi

The FSSAI ensures food quality in India through regulations. Businesses must comply for secure operations. FSSAI registration offers various benefits.

- Ensuring food safety through inspections and vigilant surveillance.

- Access financial services, credit, foreign currency loans, import/export licenses, and more.

- Preventing vendor malpractices, like adulteration and supplying substandard materials.

- Enhanced global expansion and diversified revenue streams through exports.

- Improved opportunities for securing contracts from both government and private sectors, bolstered by brand recognition through FSSAI registration.

- Legal safeguard from authorities when adhering to all FSSAI Act compliance measures.

Eligibility for Food registration in Delhi

FSSAI categorizes FBOs into three categories for registration and licensing based on the nature, size, and turnover of the businesses.

Basic registration

Food business operators involved in manufacturing or selling food items, either directly or through retailers, hawkers, itinerant vendors, or street food stall owners, with an annual turnover not exceeding 12 lakh rupees, are eligible for basic registration.

| Food business operators | Criteria | FSSAI Registration type |

|---|---|---|

| Small food business operators like hawkers, golgappa vendors, and food van owners. | Annual turnover not exceeding 12 lakh rupees. | Basic FSSAI Registration Required. |

| Meat Processing Facilities. | 2 large animals, 10 small animals, and up to 50 poultry or birds. | Requires basic FSSAI licensing. |

| Transporters with specialized vehicles like refrigerator vans or milk tankers. | Limit of one vehicle. | Basic FSSAI license needed. |

Note : The criteria and nature of Food Business Operators (FBOs) may differ across various sub-categories and classifications. For detailed information, refer to FSSAI Basic Registration guidelines.

FSSAI State Licence

Food business operators, including manufacturers, import-export operators, restaurants, and processing units with a turnover exceeding 12 LPA up to 20 crores per annum, must obtain an FSSAI state license to operate in Delhi.

| Food Business Operators(FBOs) | Criteria For Licence | FSSAI Licence Type |

|---|---|---|

| Dairy Units, including Milk Chilling Units. | 10001 – 50,000 Litres of Milk per day, 501 MT – 2500 MT of Milk Solids per annum. | Require FSSAI state licence. |

| Vegetable Oil Processing Units, Vegetable oil products. | 1-2 MT per day. | Require FSSAI state licence. |

Note : Criteria and nature of FBOs can vary across categories. For more details, refer to FSSAI STATE LICENSE guidelines.

FSSAI Central Licence

Food business operators qualify for a central license if their annual turnover exceeds 20 crores or if they operate in central government agencies like railways, airports, and seaports.

| FBOs | Eligibility For Licence | FSSAI Licence Type |

|---|---|---|

| Proprietary Food. | No restriction on production capacity. | FSSAI Central Licence. |

| Radiation Processing Of Food | No restriction on production capacity. | FSSAI Central Licence. |

Note : FBOs may differ in criteria and nature under various categories. Learn more about it on FSSAI CENTRAL LICENSE.

FSSAI Registration Online Process

FSSAI has launched an upgraded FSSAI-FosCOS web application, simplifying the process of filling and submitting food registration and licensing applications for individuals and corporations in the industry.

Step-1 Applying for FSSAI registration

Start the application on the FosCos portal, filling forms A and B for state and central licensing as per FBO requirements. Authorities will respond within 7 working days.

Step-2 Inspection by FSSAI authorities

Following the evaluation of the FBO registration application, authorities may either accept or reject it. Depending on the status, an inspection of the premises may be ordered for further processing.

Step-3 Clearance for approval

Following a satisfactory inspection of the business premise and document verification, approval will be granted for issuing the FSSAI registration or license, depending on the nature of the business.

Step-4 Issue of FSSAI registration/licence

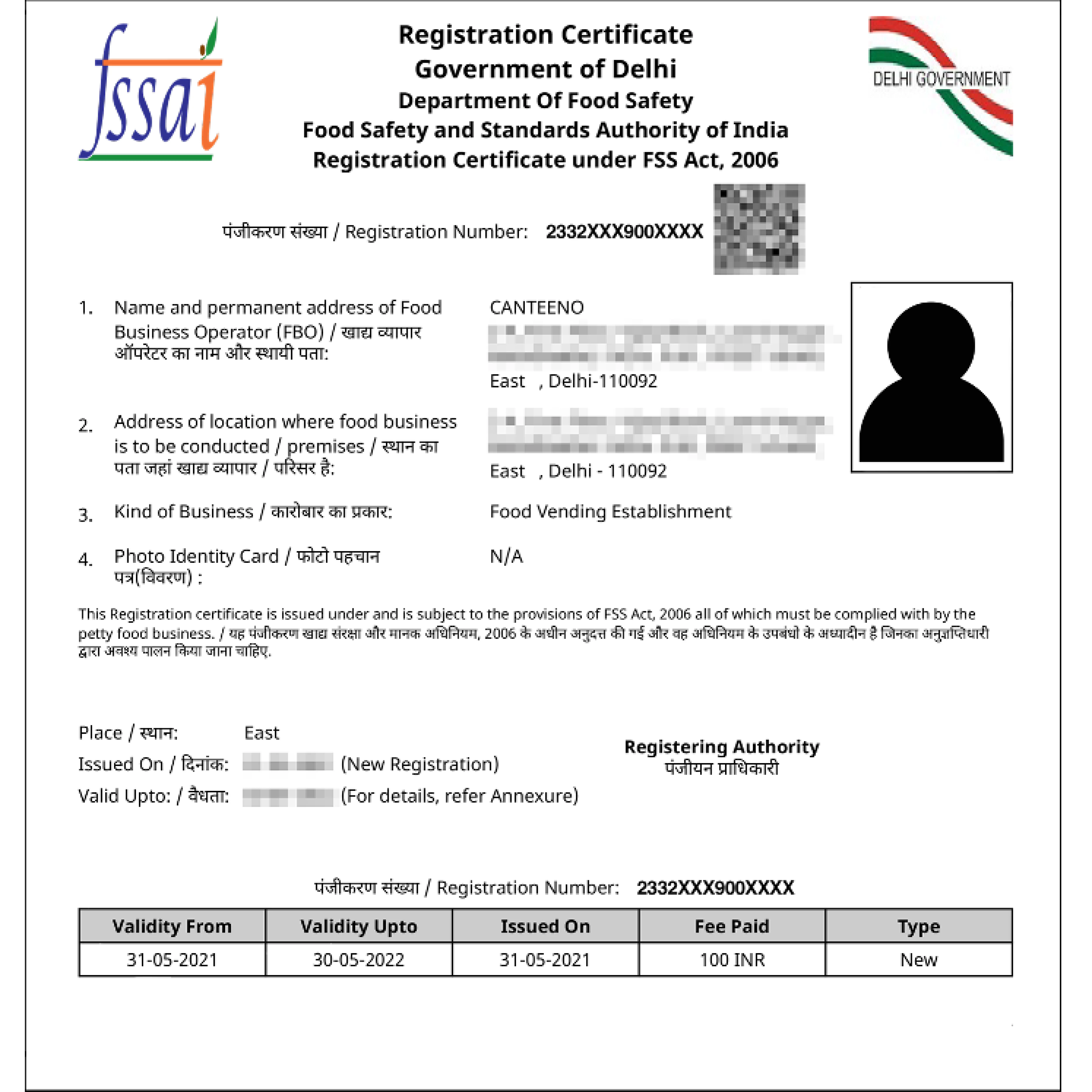

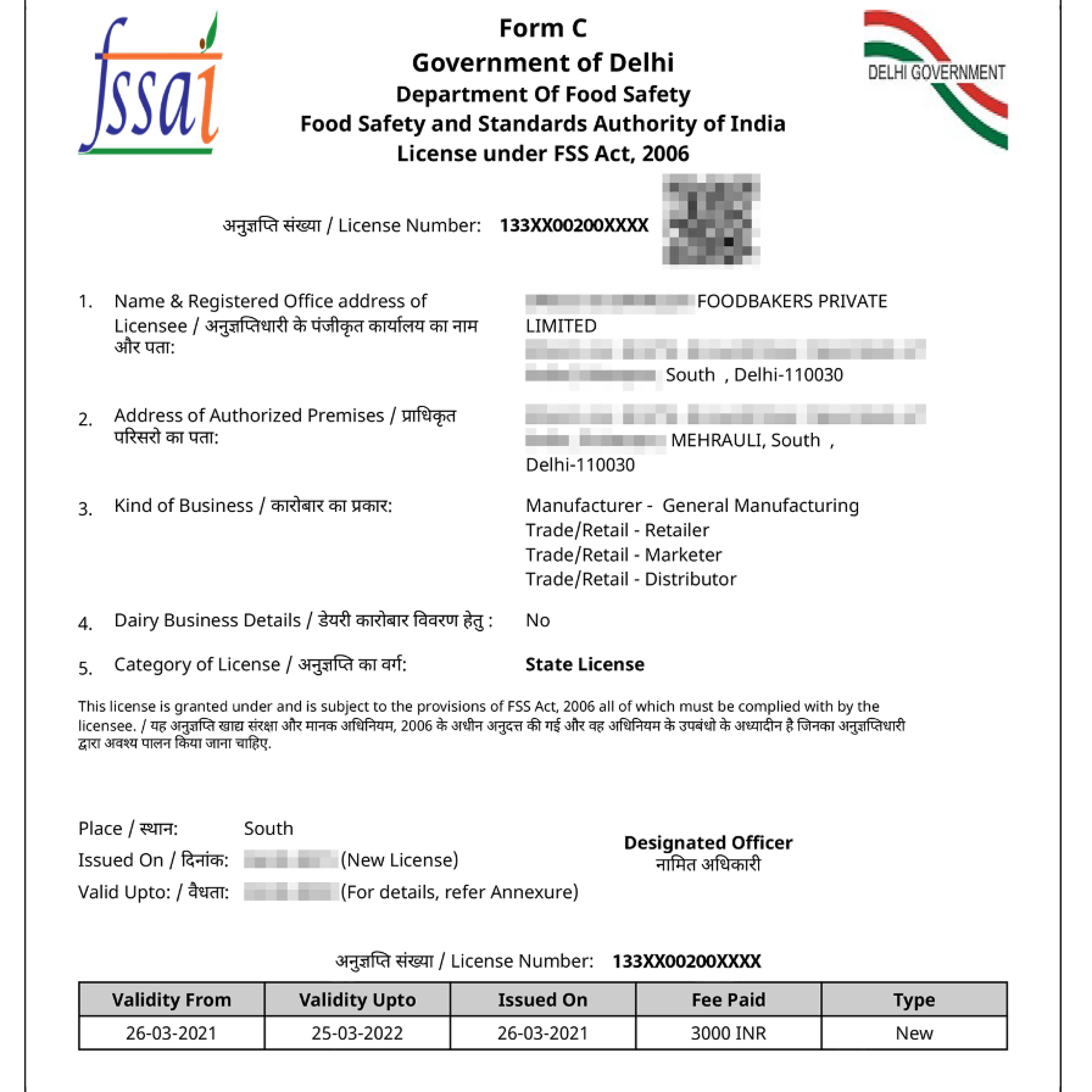

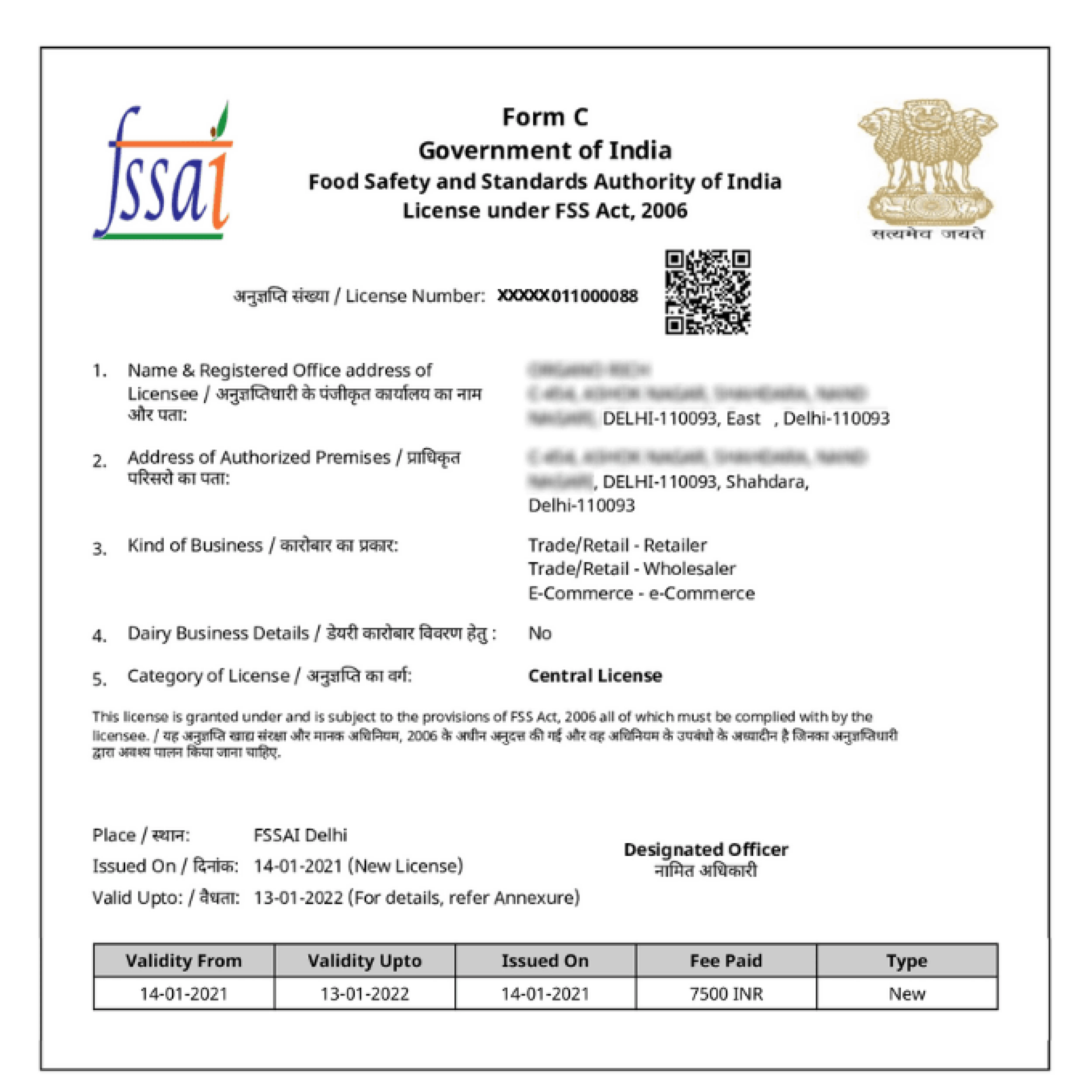

Following approval, FSSAI will issue a registration/licence certification with a unique 14-digit number. Displaying it during business hours and printing on all products is mandatory for compliance.

Keep tabs on your FSSAI license application status effortlessly through our dedicated FSSAI application status checker tool available online.

Documents required for FSSAI registration in Delhi

- For Basic Registration

- For State FSSAI Licence

- For Central FSSAI Licence

1. Declaration through form A

2. Address proof

3. Form IX nomination of a person by a company along with the board. (form IX is not required in the case of a proprietor)

4. Government-issued identity card

5. Detail of kind of business ( KOB )

6. NOC from the municipality or any recognised legal local body “if required”

7. Source of raw material

1. Form B application for licence/renewal of a licence under FSS act 2006

2. Premise details in square metres and metres along with layout

3. Recall plan

4. Form IX nomination

5. List of directors with full details in case of a company

6. Partnership deed / self-declaration for Proprietorship

7. Copy of certificate obtained under Coop Act-1861/ Multi-State Coop Act-2002 in case of Cooperative (wherever applicable)

8. In the case of groundwater NOC from CGWA is necessary

9. Name and list of equipment and machinery along with numbers

10. Authorised identity proof

1. Self-declaration through form B

2. NOC from municipality

3. Proof of ownership of the premise or NOC from the owner “ if rented

4. Authorised Photo identity card

5. Import-export code issued by DGFT

6. Mandatory registration for all owned outlets and central licence for head office in case of running multiple chains in all different states and locations

7. Ministry of commerce certificate for 100% EOU

8. Certification from the ministry of tourism in the case of hotels

9. NOC/PA issued by FSSAI

10. Food safety management plan

11. Must have certificate obtained under COOP-act 1861 and multi-state act 2002

12. The Source of raw materials must be provided

13. In case of water is used as an ingredient then must have a test report of water from the authorised test report from concerned authorities

FSSAI registration licence and renewal fee in Delhi

As per the FSS guidelines the registration & license fee for FSSAI is classified into 3 classes.

1. For basic registration fee would be 100% per annuam

2. For State license it would range from 2000-5000 each year

3. For central Fssai food license is 7500% + 18% GST annually

Also, in addition burden of 18% goods and services tax on fssai fees and penalty has to be carry by the applicant.

Note : Our professional charges are not included into the above mentioned pricing.

| Type of Licensing | FSSAI license Cost |

|---|---|

| Basic registration | Rs. 100 per year |

| State licence | Rs. 2,000 – 5,000 per year |

| Central licence | Rs. 7,500 + 18% GST per year |

| Renewal Fee | Same as licensing fee |

Note :Under the new FSSAI norm, applicants pay an initial fee of $1000 + 18% GST for FSSAI licenses. After processing and approval, the remaining differential amount, including the license fee and GST, must be paid within 30 working days. Failure to do so results in auto-rejection of approval. Compliance with this financial obligation is crucial for a successful and smooth licensing process under FSSAI regulations.

FSSAI Registration: Consultants in Delhi

Professional Utilities provides an end-to-end service for online food licensing and FSSAI registration. With us you get:

- FSSAI registration within smallest time frame

- Lowest FSSAI registration fees

- Comprehensive help with FSSAI online application filling

- Guidance on selecting the right food licence type

- Support throughout the registration procedure

- Solution to all your questions and concerns

FSSAI Registration Online Renewal And Validity

- 1. FSSAI grants licenses for a minimum of 1 year and a maximum of 5 years, ensuring compliance duration.

- 2. Submit FSSAI renewal applications up to 180 days before the expiration date for timely processing.

- 3. For license renewals filed less than 30 days before expiration, FBOs must pay a late fee of INR 100 per day, in addition to the renewal fee.

- 4. For FSSAI renewal within 1-90 days post expiry, FBOs are charged 3 times the original annual fee; after 90 days, it's 5 times the original fee.

- 5. Renewal is prohibited after 180 days from the initial expiry. Utilize our FSSAI status checker to monitor your license validity and prevent late fees or cancellations.

Penalties for violation of FSSAI compliances in Delhi

- Under the Food Safety and Standards (FSS) Act, 2006, non-compliance with FSSAI regulations in Delhi may incur penalties, ranging from fines to imprisonment or registration cancellation.

- 1. The minimum penalty is Rs.1 lakh per unit or 2 years imprisonment or both.

- 2. The maximum penalty can go up to Rs. 5 lakhs per unit.

- 3. Penalties for deceptive advertisement of food products can go up to 10 lakh rupees.

- 4. Petty sellers selling substandard food may be fined up to 25,000 rupees for such violations.

- 5. Failure to properly display the registration number or license on food products is a criminal offense and may result in jail or registration cancellation.

Why Professional Utilities?

Frequently Asked Questions (FAQs)

After fulfilling registration requirements, basic registration takes 7-10 days, while state or central licenses may take up to 30 days to be processed.

As per the updated FSSAI ACT guidelines, all types of FBOs are mandated to obtain FSSAI registration for their operations.

Per the Food Safety and Standards Regulations 2011, non-compliance with FSSAI rules may lead to cancellation or jail.

Implementation of the FSSAI act is undertaken based on physical inspection, sampling of food,surveillance and monitoring by Food safety officers.

Yes, food sellers like hawkers, stalls, and food trucks earning <12 lakh rupees annually need basic FSSAI registration in Delhi under the FSS Act 2006.

FSSAI registration is categorised as follows:

The fee for basic registration is Rs. 100 per annum.

The State licence fee for FSSAI is Rs. 2,000 - 5,000 per year.

The Central licence fee for FSSAI is Rs. 7,500 per year.

Distinct licenses/registrations are essential for individual premises, even if they are located within the same district or sub-division.

The FSSAI registration/license in Delhi has a minimum validity of 1 year and can be extended to a maximum of 5 years, providing flexibility for businesses over time.